32+ Mortgage calculator 40 year term

If applicable please enter the arrangement fee as a percentage this will then be added to the total mortgage facility. 2008 the annual volume of HECM loans topped 112000.

Idiosyncratic Whisk February 2020

Thats about two-thirds of what you borrowed in interest.

. You can use the following calculators to compare 10 year mortgages side-by-side against 15-year 20-year and 30-year options. In 2016 the average mortgage term in Sweeden was reported to be 140 years before regulators set a cap at 105 years. Mortgage Early Payoff Calculator excel to calculate early mortgage payoff and total interest savings by paying off your mortgage early.

Assuming you have a 20 down payment 70000 your total mortgage on a 350000 home would be 280000. The most common terms are 15-year and 30-year term mortgages. Most commercial mortgage facilities charge a lender arrangement fee also known as a facility fee acceptance fee or booking fee which is usually a percentage of the mortgage amount being borrowed and added to the facility.

Use our comprehensive online mortgage calculator which shows the monthly interest only and repayment amounts on a mortgage. This calculator defaults to a 15-year loan term and figures monthly mortgage payments based on the principal amount borrowed the length of the loan and the annual interest rate. 10-year mortgages tend to be priced at roughly 05 to 10 lower than 30-year mortgages.

If you instead opt for a 15-year mortgage youll pay over the life of your loan or about 46 of the interest youd pay on a 30-year mortgage. On a 30-year mortgage with a 4 fixed interest rate youll pay over the life of your loan. Your total interest on a 250000 mortgage.

The following table lists historical average annual mortgage rates for conforming 30-year mortgages. This will greatly lower your overall interest. Historical 30-YR Mortgage Rates.

Discover how much you could borrow and what it could cost with our easy-to-use mortgage calculator from Principality Building Society. You can consider refinancing it to a 15-year term. Use the popular selections weve included to help speed up your calculation a monthly payment at a 5-year fixed interest rate of 5540 amortized over 25 years.

Few homes are built to last 100 years. Assuming you have a 20 down payment 24000 your total mortgage on a 120000 home would be 96000For a 30-year fixed mortgage with a 35 interest rate you would be looking at a 431 monthly payment. Dont worry you can edit these later.

Most reverse mortgages are owner-occupier loans only so that the borrower is not allowed to rent the property to a long-term tenant and move out. If you would like to pay off your mortgage sooner than planned please contact us on 0345 30 20 190 Relay UK - 18001 0345 30 20 190. A 40-year mortgage with an interest-only period With an interest-only loan mortgage payments go.

Please keep in mind that the exact cost and monthly payment for your mortgage will vary depending its length and terms. An ARM has a fixed rate for a set time for example five seven or 10 years and then adjusts periodically for the remaining loan term. A 40-year mortgage with a variable rate Borrowers can get an adjustable-rate mortgage ARM with a 40-year term.

Aug 31 2028. Please keep in mind that the exact cost and monthly payment for your mortgage will vary depending its length and terms. In 2016 and 2017 many younger borrowers across the UK have moved away from using their once-standard 25-year mortgage toward 30 35 even 40-year loan options.

A reverse mortgage is a mortgage loan. A borrower should check this if he thinks he wants to rent his property and move somewhere else. If we do reduce your monthly payments the term of your mortgage will stay the same and you will pay off your mortgage in the same amount of time.

Mortgage Balance Calculator- calculate the outstanding balance of your loan. Or seeing the monthly mortgage payment when a borrower has a plan to pay off a mortgage within a certain amount of year. Provides graphed results along with monthly and yearly amortisation tables showing the capital and interest amounts paid each year.

If you can afford it consider taking a 15-year mortgage over a 30-year term. For a 30-year fixed mortgage with a 35 interest rate you would be looking at a 1257 monthly payment.

Use The Interactive Online Emi Calculator To Calculate Your Home Loan Emi Get All Details On Inter Life Insurance Premium Life Insurance Calculator Income Tax

Download A Free Home Mortgage Calculator For Excel Analyze A Fixed Or Variable Rate Mortgage And Inclu Mortgage Loans Financial Calculators Refinance Mortgage

How To Pick A Mortgage Loan Term

Idiosyncratic Whisk Interest Rates And Home Prices

How To Pick A Mortgage Loan Term

4207 E Moody Ln Mead Wa 99021 Realtor Com

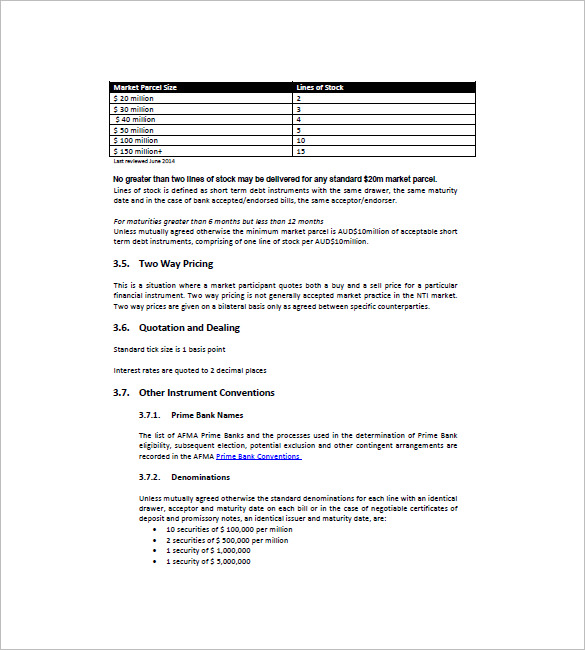

8 Negotiable Promissory Note Templates Free Sample Example Format Download Free Premium Templates

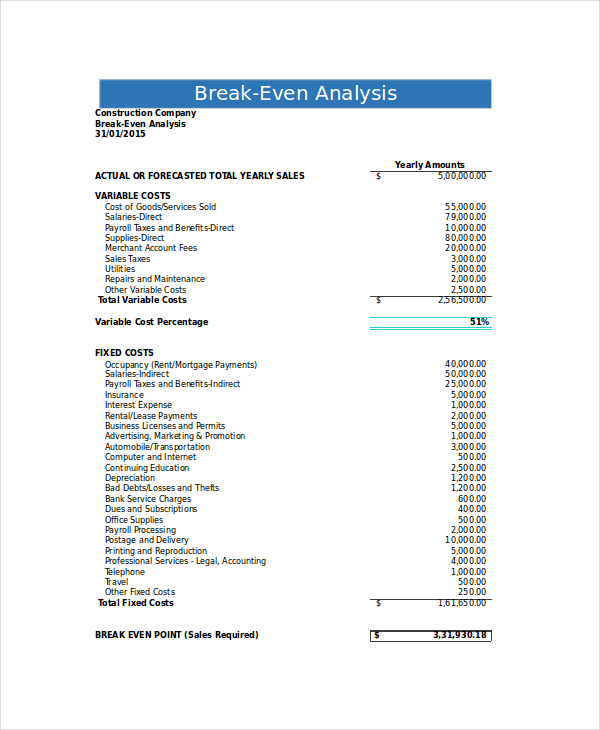

Break Even Analysis 10 Free Excel Psd Documents Download Free Premium Templates

A Href Https Www Mortgagecalculator Org Calculators Should I Refinance Php Img Src Https Www M Refinance Mortgage Refinancing Mortgage Refinance Loans

Idiosyncratic Whisk 2021

Idiosyncratic Whisk July 2019

Idiosyncratic Whisk April 2020

Home Equity Loan Calculator Mls Mortgage Home Equity Loan Calculator Mortgage Amortization Calculator Home Equity Loan

How To Pick A Mortgage Loan Term

Idiosyncratic Whisk June 2021

Idiosyncratic Whisk April 2020

Jackson Financial Inc 2021 Current Report 8 K